Soccer Fans Fought Back Against Private Equity and Won

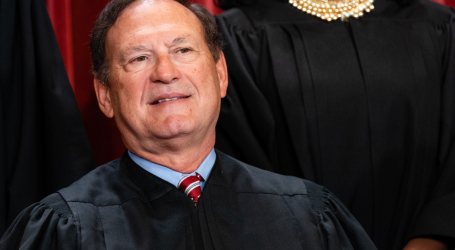

Christian Charisius/ picture-alliance / dpa / AP

Fight disinformation: Sign up for the free Mother Jones Daily newsletter and follow the news that matters.If you’ve watched any German men’s professional soccer matches recently—and I can certainly forgive you if you haven’t—you’ve seen something even more unusual than an end-of-the-season trophy presentation without Bayern Munich. For months, fans across the country have staged a series of increasingly elaborate protests against a plan by the country’s Deutsche Fußball Liga (DFL), to sell a stake in its media rights to a private equity firm.

At Wolfsburg, fans forced repeated stoppage of play by throwing tennis balls onto the field. At Mönchengladbach they threw chocolate coins. A Hamburg fan attached a bicycle lock to a goalpost during a match, forcing a stadium employee to come out with a saw and remove it. And in Rostock last weekend, fans put smoke bombs onto two remote-control cars and sent them in circles around the pitch as an attendant frantically tried to retrieve them:

📌Hansa vs. Hamburg

The protests over a private-equity investor continue in Germany, this time with flares attached to remote-control cars 🧨#Bundesliga2 #Germany pic.twitter.com/5JnCrXpC8u

— Hooligans Herald (@HooligansHerald) February 17, 2024

Fans explained the gesture with a banner: “We won’t be remote controlled.”

As I explained in a recent cover story for the magazine, soccer has become increasingly financialized over the last decade or so, with major investment firms taking over clubs, buying stakes in leagues, and even challenging the structure of the sport itself. It’s a drumbeat that’s felt both unstoppable and a little nauseating, in a way that mirrors the financialization of everything else—from media to grocery stores to housing.

But in Germany, it turned out, this wasn’t unstoppable. Last week, the US private-equity firm Blackstone dropped its bid for a share of the DFL’s media rights, leaving Luxembourg-based CVC Capital Partners as the lone remaining bidder. On Wednesday, the league announced it was pulling the plan. Similar proposals were rejected by the league twice before. The fans have won—at least for now.

That Germans managed to block the takeover does not exactly mean that everyone else will, or even can. Of all the big European leagues, Germany is the one you’d most expect to put up a fight, not just because it has a rich culture of supporter-driven political activism, but because of the way clubs are structured. A rule known as “50+1” mandates that a majority of shares for each team be owned by members of the club itself, which makes it impossible for just any old nation-state or billionaire to acquire them. So while oligarchs and petro-states bought up famous brands in England and in France, and hedge-funds and rich Americans scoured Italy for deals like Gilded-Age elites on a Grand Tour (did you know that Donald Trump’s lawyer in the first E. Jean Carroll defamation case is now on his fourth Italian club?), Germany maintained many of its old ways.

Per The Athletic’s Raphael Honigstein, the protestors had a range of complaints, ranging from the PE firms’ links to Saudi Arabia, to “fears the deal will lead to pressure on the clubs to maximise profits and further change kick-off times in pursuit of additional TV income.” But the railroading of the supporters was a recurring theme. Team representatives had essentially gone rogue to strike a deal that “lacked broad acceptance”; this was an assertion of who the league really belongs to—not just on paper, but on some deeper level.

Professional sports sort of seems like one of the more benign things private equity could speculate in. The workers—at least the ones you see—are doing more than okay. No one is going Toys-R-Us-mode on the Olympiastadion Berlin. Who really cares if Stephen Schwarzman skims a bit of money off of someone else’s television contract?

But lingering at the center of these fights over private-equity is a sense that giving an investment-shop a stake in your business transforms it into something altogether different than it was before. It might come with an infusion of money, but that money very rarely comes without strings and it is never, ever sentimental. Unlike a lot of American professional sports teams—which began as expensive franchises in billion-dollar entertainment cartels, and can be moved from city to city—European clubs had their start as community organizations. The commodification came much later, egged on by American companies and investors, and there’s a lot of resentment at the way things are playing out. The German uprising is not the first time that fans on the continent have rebelled against the influence of outside investors.

Maybe soccer will be the exception—a rare industry in which a bunch of people with no connections to the product swoop in and make everything better for the people who care about it most. But you can’t blame anyone for not taking that bet.

Just look at the other big private-equity company in the news for its soccer investments right now. The English Premier League club Everton has ended up in a huge financial mess after a tumultuous decade in which it was acquired by the business partner of the now-sanctioned Russian oligarch, Alisher Usmanov. Now there’s a new owner on the horizon—the US private equity firm 777 Partners, which according to the Washington Post, is buying up soccer teams with money it made “as one of the biggest buyers of structured settlement annuities.” Do you need to read that story to know that critics have called their business model “exploitative”? No, I don’t think so—but I would recommend it.

It’ll take a lot more than some tennis balls and chocolate to stop PE from getting its bag. But it’s good to remember it’s still possible.