Maybe the Economy Isn’t as Great as We Think

Looking for news you can trust?Subscribe to our free newsletters.

Is the economy getting close to full capacity? Arguing for the affirmative is the unemployment rate, which is very low. Arguing for the negative is the inflation rate, which is also low. If the economy were truly running at capacity, companies would be bidding up prices for workers and inflation would be climbing. But it’s not. For example, here’s the annual growth of the Employment Cost Index, which measures both wages and benefits:

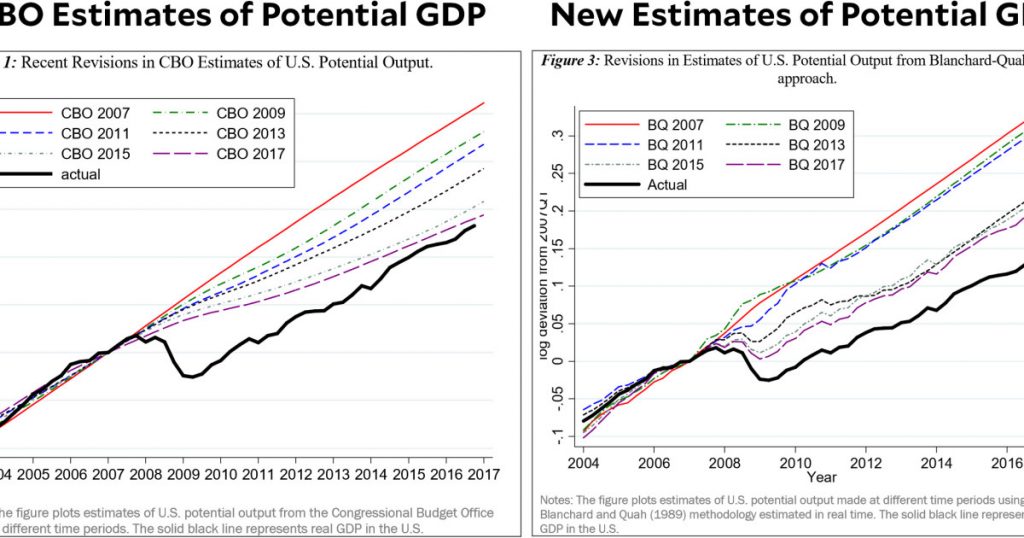

The ECI isn’t growing much faster than inflation, which means it’s not putting any upward pressure on wages and prices. What’s more, it’s been decelerating for the past three years. So why does everyone think that the economy is running at full capacity, with GDP bumping right up against potential GDP? Jared Bernstein points to a new paper that suggests the problem is with the way potential GDP is being calculated. The Congressional Budget Office has been lowering its estimates for years, but the authors of the paper think they’ve lowered it too much:

Bernstein explains what the authors of the new paper are doing:

They borrow a statistical method from a paper by Blanchard and Quah that they claim does a better job separating out temporary and permanent shocks to the economy.

….Here’s why that’s so important. Suppose the economy gets whacked by a negative shock like the bursting of a credit bubble. A bunch of people temporarily leave the labor market. A bunch of firms cut back on their investment. Recession ensues. That’s a classic, temporary demand shock. The fundamental supply factors that drive long-term economic growth—labor supply, innovation, the amount of capital per worker—haven’t been permanently thrown off course. Once balance sheets recover and credit flows resume, the economy should make up its losses and revert back to its previous growth rate.

Contrast that with a permanent supply shock, like the one with which we and some other advanced economies are currently dealing: an aging population….that lastingly slows the long-term growth of the labor force and thus lowers potential GDP.

The problem that [the authors] document is that current statistical methods employed by the Fed, CBO, and others conflate these two types of shocks, often mistaking temporary downgrades for permanent ones. That, in turn, leads policy makers, like those meeting across town as we speak, to underestimate the size of potential GDP.

Needless to say, I won’t pretend to have the chops to comment on the technical issues here. But it’s a serious paper, and if the authors are right it would solve one of the paradoxes of the current economy: the reason inflation isn’t picking up yet is because the economy isn’t close to its current capacity yet.

If this is true, however, it opens up another question: what’s wrong with the headline unemployment figure? It’s currently running at 4.1 percent, which should signify a very tight labor market. In the past it certainly has. So why isn’t it doing so now?