Chart of the Day: More Houses Equals Bigger Housing Crash

Looking for news you can trust?Subscribe to our free newsletters.

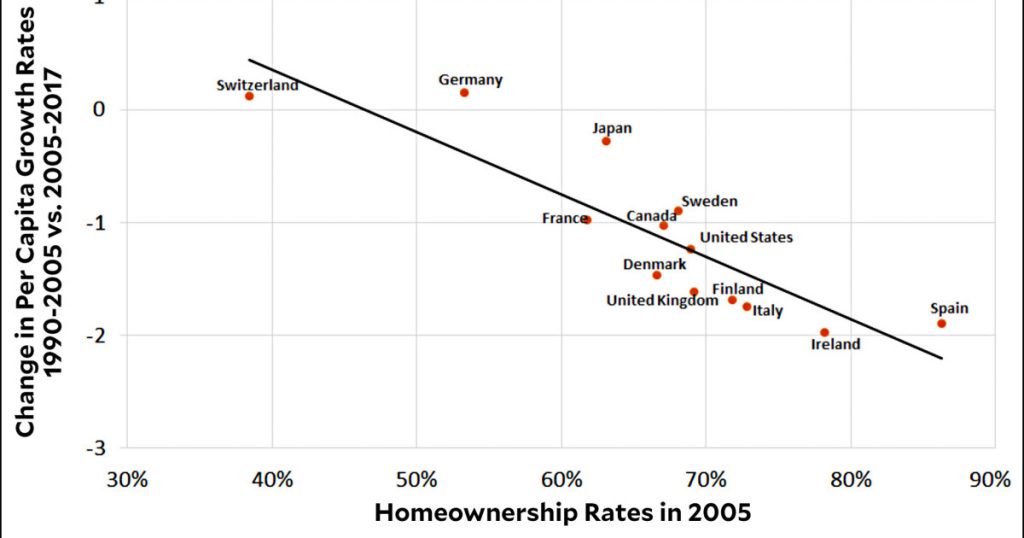

Here’s an interesting chart from the St. Louis Fed. It shows exactly what you’d expect, but it’s still nice to see it demonstrated so clearly:

What this chart shows is simple:

Countries with high homeownership rates (on the right) had the biggest housing bubbles and the biggest crashes.

The effects of those crashes persisted for over a decade.

Today, the countries with the biggest crashes (on the bottom) are still feeling the worst effects on growth rates.

Switzerland and Germany, with low homeownership rates, are growing today at about the same rate as they were before the financial crisis. The US, with a fairly high homeownership rate, is growing about one percentage slower. Ireland and Spain, with huge homeownership rates, were hit the hardest and are still feeling the greatest pain. Their growth rates are two points lower than they were pre-crisis.

But there’s another point to make about this chart: although it’s unlikely that this relationship between housing and growth could have been eliminated completely, the fact that it’s so strong is powerful confirmation that the political response to the crash was far too weak—and it was far too weak everywhere. If the US, to pick an example, had responded with stronger and longer fiscal/monetary/regulatory policies, it could have made up the lost demand from the housing crash far more quickly and gotten back to its old growth rate in a year or three, instead of ten.

Some countries, like Ireland and Spain, were handcuffed by the euro and weren’t strong enough or independent enough to respond properly on their own. In those cases, some of the blame resides in Germany and France, the big EU core countries.

The world’s large economies did respond to the crash. And it’s only fair to acknowledge that, to this day, you can point to no more than one or two countries that have responded to a banking crisis with the proper vigor even after the lesson of the Great Depression. Unfortunately, the prospect of truly massive stimulus seems to be scarier than the prospect of future economic sluggishness. Even now, with abundant evidence that strong stimulus had little to no impact on inflation, I expect that if the global economy crashed tomorrow we’d still be too timid to respond to it with the energy it requires. Our financial class has learned nothing and forgotten everything.