As Climate Outlook Worsens, Republicans Go After “Woke” Capitalism

Florida Gov. Ron DeSantis announced his state would divest about $2 billion from BlackRock, a Wall Street firm that advocates for environmentally conscious investing.John Locher/AP

This story was originally published by Inside Climate News and is reproduced here as part of the Climate Desk collaboration.

It has only been a decade since climate activists launched campaigns to get financial institutions and money managers to see that dollars pumped into the fossil fuel industry were a risk to both the planet and investor portfolios.

That effort has had some success but remains a work in progress. All of Wall Street now talks about environmental, social, and governance (ESG) principles in investing, and that’s a problem. Claims of a commitment to that philosophy are ubiquitous among corporations and investment funds, and investors are left to figure out which declarations amount to mere greenwashing. Only within the last year have government watchdogs moved to set standards on what companies must disclose about climate risks.

Before those rules are set, Republicans have decided the time is right for an anti-ESG backlash. In 2023, they are preparing on multiple fronts to take on Wall Street, corporate America, and US financial regulators for, in their view, paying too much attention to environmental concerns and not enough to making money.

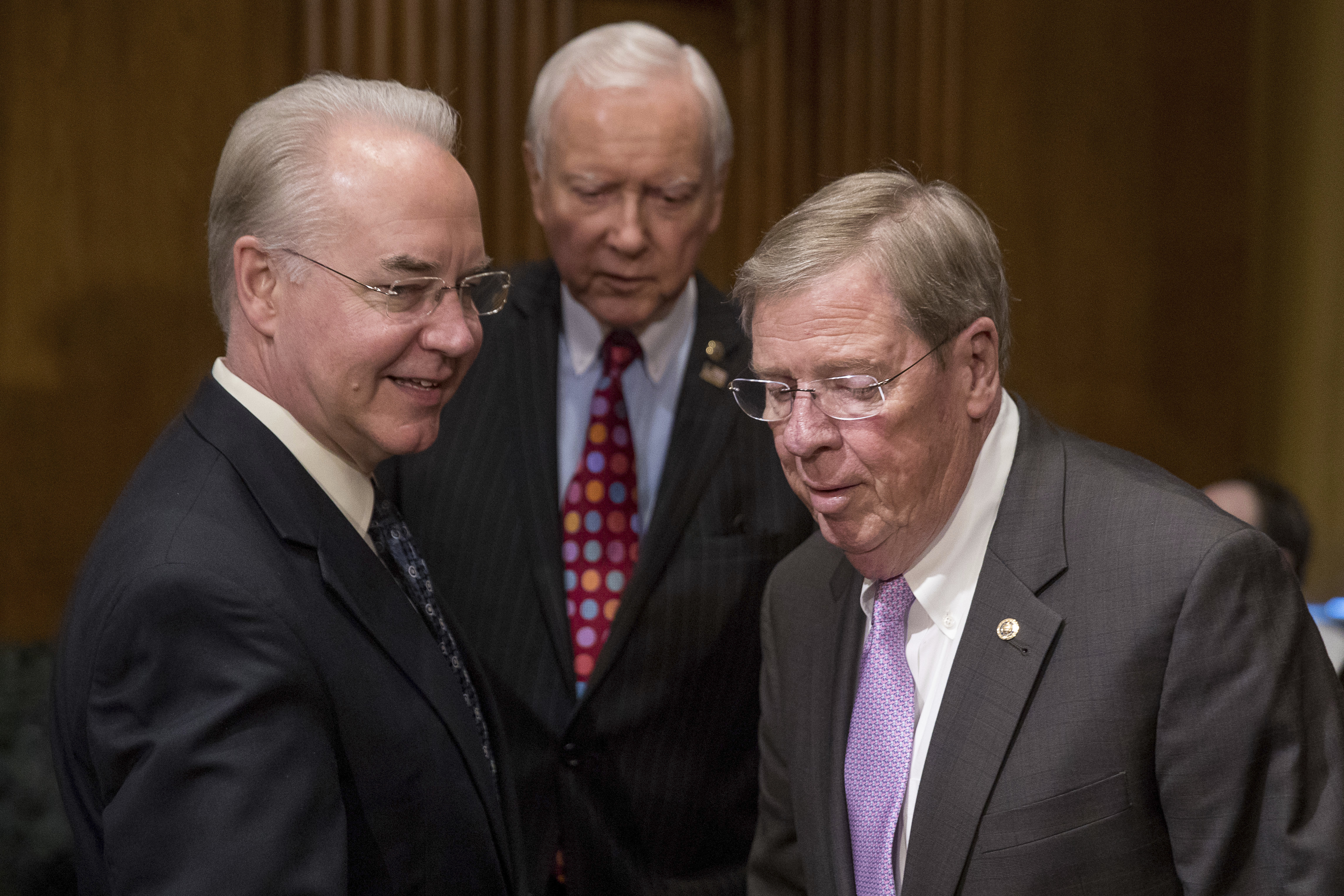

It’s “woke capitalism,” in the words of Florida Gov. Ron DeSantis, widely seen as a possible challenger to former President Donald Trump for leadership of the Republican Party. DeSantis’ administration announced last month that it was pulling out all Florida State Treasury funds—some $2 billion—that were invested with BlackRock, the Wall Street firm that has become most closely associated with ESG.

Attorneys general also are zeroing in on what they say are the antitrust concerns raised by investment firms participating in coalitions like the Net Zero Asset Managers, a group formed in 2020 to support the global drive to reduce carbon emissions to zero by 2050. They argue that such efforts are preventing certain industries—primarily coal—from obtaining financing.

“If you have collusion between a large portion of the financial sector such that financing is only available to certain preferred industries, or if there’s proxy voting moving in a direction that’s functionally regulation, that is people with money deciding how the world is going to look,” said Tennessee’s attorney general, Jonathan Skrmetti, at an ESG forum hosted last month by the National Association of Attorneys General. “And that’s oligarchy.”

Just by raising the antitrust issue, the GOP AGs may have had an impact. Last month, the world’s biggest mutual fund manager, Vanguard, said it would leave the Net Zero coalition in order “to make clear that Vanguard speaks independently on matters of importance to our investors.” The move came days after Republican attorneys general filed an unusual challenge to Vanguard’s application before US regulators to expand its holdings in utilities.

In addition to Florida, five other Republican-led states have pulled state Treasury funds out of BlackRock over ESG concerns. For BlackRock, it’s an insignificant $3 billion drop from its $7.9 trillion bucket of assets under management. But such moves could spread, especially with the ALEC-led campaign to change state laws to bar state pension funds from considering ESG factors in investing.

“I would say at least 25 state legislatures, maybe more, are going to consider votes on ESG bills in 2023,” said Kris Kobach, the Republican attorney general-elect of Kansas at the attorneys general forum last month. “This is probably one of the hottest topics in state legislatures right now.”

It’s not clear that the Republican politicians’ anti-ESG drive resonates with GOP voters. A recent survey of more than 1,200 voters by Penn State’s Center for the Business of Sustainability and the communications firm ROKK Solutions found that a majority of both Republicans and Democrats oppose restrictions on ESG investments. That’s not surprising, since sustainability initiatives at corporations are correlated with better financial performance, according to a review of more than 1,000 studies on the subject by researchers at New York University’s Stern Center for Sustainable Business.

But the anti-ESG moves now underway could mean less information for investors on what companies are really doing on the climate front, and less access to ESG options for pensioners in some states.

“What’s going on in the political arena is not just disappointing, it’s sad and it’s disruptive,” said Kristina Wyatt, senior vice president for global regulatory climate disclosure at the climate data firm Persefoni. She served as senior counsel for climate and ESG at the SEC in the first year of the Biden administration and worked on the agency’s climate risk disclosure proposal.

“There’s so much urgency to the climate crisis,” Wyatt said. “And investors deserve to have climate risks and opportunities associated with climate change properly factored into the investment decisions that are being made on their behalf.”