Consumers Are Way Off Base About Inflation

I was over at the Conference Board site checking out consumer sentiment, and I was unsurprised to find that it’s pretty dismal: down from 98 in June to 92 in July. There’s not much to say about this aside from “what else would you expect?”

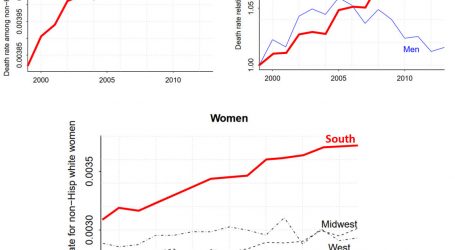

But then I browsed through the whole news release and came across something I hadn’t seen before: expectations of future inflation rates. What caught my eye is that in July the average expectation in the Conference Board’s survey for inflation one year from now is 6.1 percent. Yowza! We haven’t had inflation that high for 30 years, and over the past twelve months it’s been running at about 2 percent. Here’s a comparison of survey expections with expectations based on bond prices put together by the Cleveland Fed:

As I said, I’ve never seen this before so I’m not sure what to make of it. But what it says is that no matter how long inflation has been low, ordinary consumers insist on believing that it will go up to 4-5 percent any day now. And if something bad happens, it will go up to 6 percent.

I’m trying to think of what effect this has. What are the upsides and downsides of consumers thinking that inflation is far higher than it really is? They’ll probably feel cheated by a 3 percent raise or a 2 percent return on their savings. On the other hand, they might increase their spending if they think their money is losing value and there’s nothing they can do about it.

What else? I’m a little fuzzy this morning, but there must be more profound consequences of this disconnect.